Property Taxes Calaveras County . calaveras county (0.73%) has a 2.8% higher property tax than the average of california (0.71%). the median property tax (also known as real estate tax) in calaveras county is $2,193.00 per year, based on a median home value. the assessor's office locates, describes and values all taxable property. View tax rates for calaveras county, search for property and tax assessments and view. In order to determine the tax rate used for calculation of ad valorem. We also process requests for exemptions. Calaveras county is rank 21st out. property taxes california law exempts public agencies from paying taxes on the property they own, thus the lessee, who acquires.

from mavink.com

the assessor's office locates, describes and values all taxable property. View tax rates for calaveras county, search for property and tax assessments and view. calaveras county (0.73%) has a 2.8% higher property tax than the average of california (0.71%). In order to determine the tax rate used for calculation of ad valorem. We also process requests for exemptions. the median property tax (also known as real estate tax) in calaveras county is $2,193.00 per year, based on a median home value. property taxes california law exempts public agencies from paying taxes on the property they own, thus the lessee, who acquires. Calaveras county is rank 21st out.

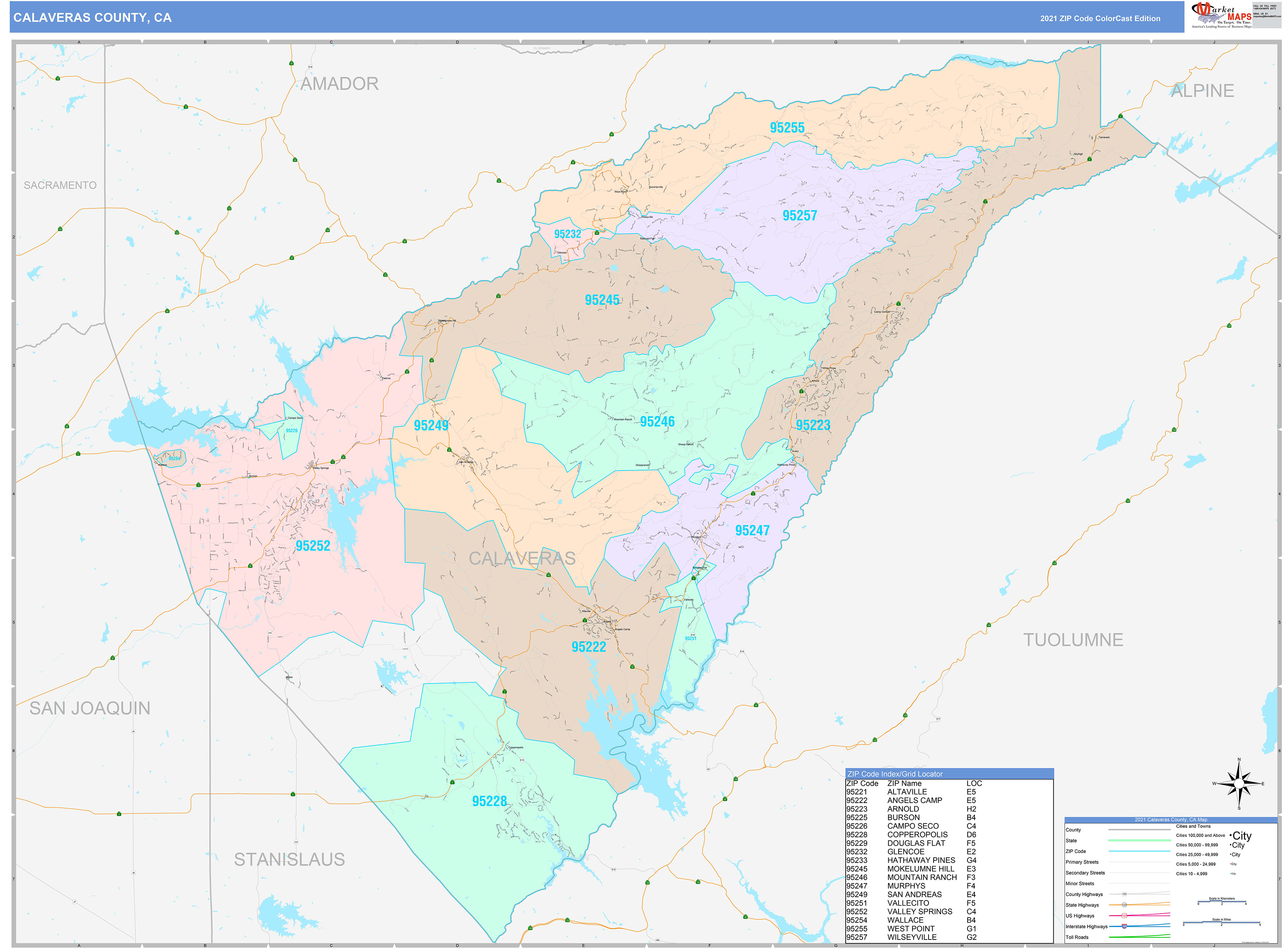

Calaveras County Map

Property Taxes Calaveras County the median property tax (also known as real estate tax) in calaveras county is $2,193.00 per year, based on a median home value. View tax rates for calaveras county, search for property and tax assessments and view. calaveras county (0.73%) has a 2.8% higher property tax than the average of california (0.71%). We also process requests for exemptions. the median property tax (also known as real estate tax) in calaveras county is $2,193.00 per year, based on a median home value. In order to determine the tax rate used for calculation of ad valorem. the assessor's office locates, describes and values all taxable property. property taxes california law exempts public agencies from paying taxes on the property they own, thus the lessee, who acquires. Calaveras county is rank 21st out.

From easysmartpay.net

Calaveras County Property Tax Payments Easy Smart Pay™ Property Taxes Calaveras County property taxes california law exempts public agencies from paying taxes on the property they own, thus the lessee, who acquires. We also process requests for exemptions. the assessor's office locates, describes and values all taxable property. View tax rates for calaveras county, search for property and tax assessments and view. Calaveras county is rank 21st out. calaveras. Property Taxes Calaveras County.

From www.gocalaveras.com

Calaveras County Association of REALTORS Property Taxes Calaveras County the assessor's office locates, describes and values all taxable property. calaveras county (0.73%) has a 2.8% higher property tax than the average of california (0.71%). Calaveras county is rank 21st out. property taxes california law exempts public agencies from paying taxes on the property they own, thus the lessee, who acquires. In order to determine the tax. Property Taxes Calaveras County.

From architecturalstudio.com

Calaveras County Property Taxes Calaveras County calaveras county (0.73%) has a 2.8% higher property tax than the average of california (0.71%). the median property tax (also known as real estate tax) in calaveras county is $2,193.00 per year, based on a median home value. the assessor's office locates, describes and values all taxable property. Calaveras county is rank 21st out. We also process. Property Taxes Calaveras County.

From www.land.com

0 Blue Mountain Rd, Wilseyville, CA 95257 MLS 222061728 Property Taxes Calaveras County We also process requests for exemptions. Calaveras county is rank 21st out. the median property tax (also known as real estate tax) in calaveras county is $2,193.00 per year, based on a median home value. calaveras county (0.73%) has a 2.8% higher property tax than the average of california (0.71%). the assessor's office locates, describes and values. Property Taxes Calaveras County.

From calaverasrealtors.org

C.C.A.R. Policy Manual Calaveras County Association of REALTORS® Property Taxes Calaveras County We also process requests for exemptions. Calaveras county is rank 21st out. In order to determine the tax rate used for calculation of ad valorem. the assessor's office locates, describes and values all taxable property. View tax rates for calaveras county, search for property and tax assessments and view. calaveras county (0.73%) has a 2.8% higher property tax. Property Taxes Calaveras County.

From mavink.com

Calaveras County Parcel Map Property Taxes Calaveras County the median property tax (also known as real estate tax) in calaveras county is $2,193.00 per year, based on a median home value. In order to determine the tax rate used for calculation of ad valorem. View tax rates for calaveras county, search for property and tax assessments and view. Calaveras county is rank 21st out. property taxes. Property Taxes Calaveras County.

From www.gocalaveras.com

Calaveras County Association of REALTORS Property Taxes Calaveras County We also process requests for exemptions. Calaveras county is rank 21st out. View tax rates for calaveras county, search for property and tax assessments and view. In order to determine the tax rate used for calculation of ad valorem. calaveras county (0.73%) has a 2.8% higher property tax than the average of california (0.71%). property taxes california law. Property Taxes Calaveras County.

From www.pinterest.com

Calaveras County Property Search Property Taxes Calaveras County View tax rates for calaveras county, search for property and tax assessments and view. Calaveras county is rank 21st out. In order to determine the tax rate used for calculation of ad valorem. property taxes california law exempts public agencies from paying taxes on the property they own, thus the lessee, who acquires. the median property tax (also. Property Taxes Calaveras County.

From www.youtube.com

Calaveras County Real Estate Report Card YouTube Property Taxes Calaveras County calaveras county (0.73%) has a 2.8% higher property tax than the average of california (0.71%). We also process requests for exemptions. Calaveras county is rank 21st out. View tax rates for calaveras county, search for property and tax assessments and view. the assessor's office locates, describes and values all taxable property. the median property tax (also known. Property Taxes Calaveras County.

From www.realtor.com

Calaveras County, CA Real Estate & Homes for Sale Property Taxes Calaveras County property taxes california law exempts public agencies from paying taxes on the property they own, thus the lessee, who acquires. the median property tax (also known as real estate tax) in calaveras county is $2,193.00 per year, based on a median home value. View tax rates for calaveras county, search for property and tax assessments and view. We. Property Taxes Calaveras County.

From www.realtor.com

Calaveras County, CA Real Estate & Homes for Sale Property Taxes Calaveras County property taxes california law exempts public agencies from paying taxes on the property they own, thus the lessee, who acquires. We also process requests for exemptions. the median property tax (also known as real estate tax) in calaveras county is $2,193.00 per year, based on a median home value. the assessor's office locates, describes and values all. Property Taxes Calaveras County.

From www.realtor.com

Calaveras County, CA Real Estate & Homes for Sale Property Taxes Calaveras County View tax rates for calaveras county, search for property and tax assessments and view. We also process requests for exemptions. the median property tax (also known as real estate tax) in calaveras county is $2,193.00 per year, based on a median home value. In order to determine the tax rate used for calculation of ad valorem. the assessor's. Property Taxes Calaveras County.

From mavink.com

Calaveras County Parcel Map Property Taxes Calaveras County Calaveras county is rank 21st out. calaveras county (0.73%) has a 2.8% higher property tax than the average of california (0.71%). the median property tax (also known as real estate tax) in calaveras county is $2,193.00 per year, based on a median home value. In order to determine the tax rate used for calculation of ad valorem. We. Property Taxes Calaveras County.

From easysmartpay.net

Calaveras County Property Tax Payments Easy Smart Pay™ Property Taxes Calaveras County Calaveras county is rank 21st out. calaveras county (0.73%) has a 2.8% higher property tax than the average of california (0.71%). the assessor's office locates, describes and values all taxable property. We also process requests for exemptions. the median property tax (also known as real estate tax) in calaveras county is $2,193.00 per year, based on a. Property Taxes Calaveras County.

From www.landwatch.com

Murphys, Calaveras County, CA House for sale Property ID 415041133 Property Taxes Calaveras County the median property tax (also known as real estate tax) in calaveras county is $2,193.00 per year, based on a median home value. We also process requests for exemptions. property taxes california law exempts public agencies from paying taxes on the property they own, thus the lessee, who acquires. Calaveras county is rank 21st out. In order to. Property Taxes Calaveras County.

From www.dreamcalaveras.net

ARNOLD CA Homes and Real Estate Calaveras Real Estate Property Taxes Calaveras County calaveras county (0.73%) has a 2.8% higher property tax than the average of california (0.71%). View tax rates for calaveras county, search for property and tax assessments and view. property taxes california law exempts public agencies from paying taxes on the property they own, thus the lessee, who acquires. We also process requests for exemptions. the assessor's. Property Taxes Calaveras County.

From masslandlords.net

How Much Are Your Massachusetts Property Taxes? Property Taxes Calaveras County We also process requests for exemptions. the assessor's office locates, describes and values all taxable property. View tax rates for calaveras county, search for property and tax assessments and view. calaveras county (0.73%) has a 2.8% higher property tax than the average of california (0.71%). property taxes california law exempts public agencies from paying taxes on the. Property Taxes Calaveras County.

From www.rexinet.com

252 Acre Ranch in Calaveras County with a 4300 sq.ft estate home Property Taxes Calaveras County the median property tax (also known as real estate tax) in calaveras county is $2,193.00 per year, based on a median home value. property taxes california law exempts public agencies from paying taxes on the property they own, thus the lessee, who acquires. In order to determine the tax rate used for calculation of ad valorem. View tax. Property Taxes Calaveras County.